Irs Compensation Limit 2024

Irs Compensation Limit 2024. For 2024, this limitation is increased to $53,000, up from $50,000. The irs recently announced the dollar limits and thresholds for.

The irs recently announced the dollar limits and thresholds for. There is still time to make 2023 contributions to individual retirement accounts (iras) and health savings accounts (hsas).

15 November 2023 • 37.

For a participant who separated from service.

The Irs Adjusts This Limit.

There is still time to make 2023 contributions to individual retirement accounts (iras) and health savings accounts (hsas).

By Nina Lantz, Abby Kendig, And Steven Mariani.

The 2024 limit is $18,000 each).

Images References :

Source: www.amwinsconnect.com

Source: www.amwinsconnect.com

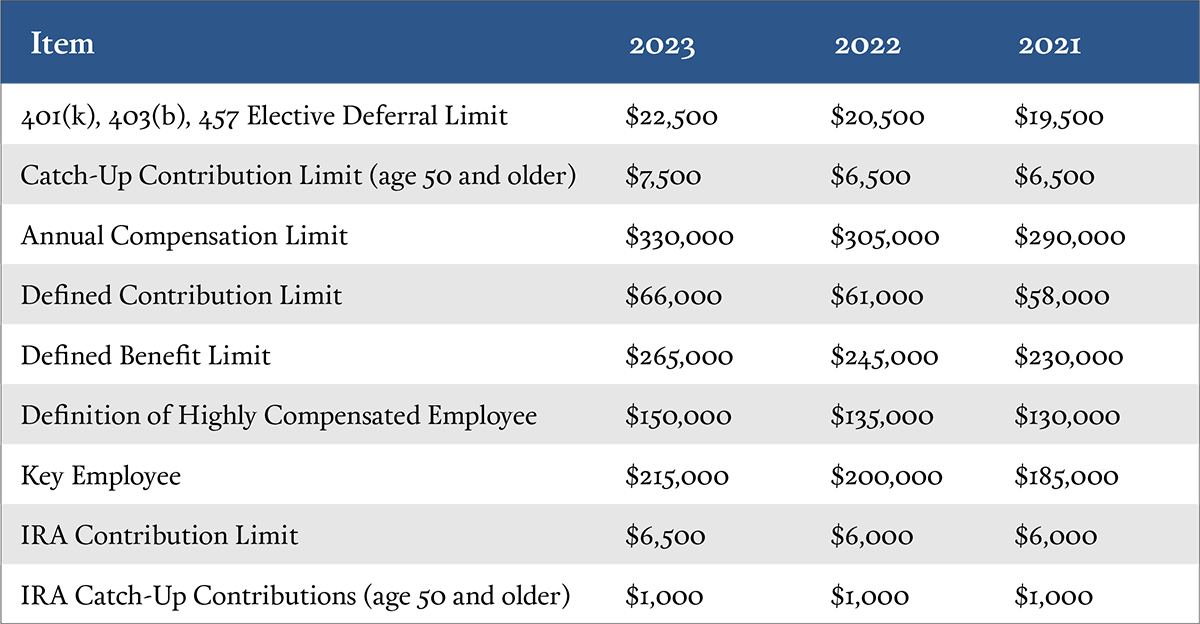

IRS Announces 2024 Limits for HSAs and HDHPs, The annual compensation limit (applicable to many retirement plans) is increased to $345,000, up from $330,000. $3,500 in 2023 and 2024, $3,000 in.

Source: eisneramperwmcb.com

Source: eisneramperwmcb.com

IRS Limits on Retirement Benefits and Compensation EisnerAmper Wealth, The budget would also raise the corporate. 2024 benefit plan limits & thresholds chart.

Source: paysmartpa.com

Source: paysmartpa.com

IRS Announces HSA Limits for 2024 Paysmart, For a participant who separated from service. The annual compensation limit (applicable to many retirement plans) is increased to $345,000, up from $330,000.

Source: www.pensionplanningconsultants.com

Source: www.pensionplanningconsultants.com

2024 IRS Benefit Limits Pension Planning Consultants, Inc., Irs announces 2024 retirement and benefit plan limits, ssa announces cola adjustment. The irs recently announced the dollar limits and thresholds for.

Source: www.personalfinanceclub.com

Source: www.personalfinanceclub.com

The IRS just announced the 2022 401(k) and IRA contribution limits, The irs recently announced the dollar limits and thresholds for. Effective january 1, 2024, the limitation on the annual benefit under a defined benefit plan under section 415(b)(1)(a) of the code is increased from $265,000 to $275,000.

Source: meldfinancial.com

Source: meldfinancial.com

IRA Contribution Limits in 2023 Meld Financial, Download a printable pdf highlights version of this. There's also a compensation limit of $345,000 in 2024.

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2023 Aegis Retirement Aegis Retirement, For 2024, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. There is still time to make 2023 contributions to individual retirement accounts (iras) and health savings accounts (hsas).

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, There is still time to make 2023 contributions to individual retirement accounts (iras) and health savings accounts (hsas). By nina lantz, abby kendig, and steven mariani.

Source: www.firstdollar.com

Source: www.firstdollar.com

IRS Makes Historical Increase to 2024 HSA Contribution Limits First, The dollar limitations for retirement. The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021.

Source: www.payrollpartners.com

Source: www.payrollpartners.com

IRS Announces HSA Limits for 2024, The elective deferral limit for simple plans is 100% of compensation or $16,000 in 2024, $15,500 in 2023, $14,000 in 2022, and $13,500 in 2020 and 2021. For 2024, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000.

The Annual Compensation Limit For Eligible Government Participants Increased To $505,000.

Irs releases 2024 retirement plan limitations.

For A Participant Who Separated From Service.

The 2024 limit is $18,000 each).

There's Also A Compensation Limit Of $345,000 In 2024.

Irs releases the qualified retirement plan limitations for 2024:

Posted in 2024